Dolan McEniry Core Plus is a U.S. corporate bond strategy that utilizes a blend of 75% investment grade and 25% high yield corporate bonds. Clients choose to benchmark this product against the Bloomberg Aggregate Index or Bloomberg U.S. Intermediate Credit Index.

Dolan McEniry Core Plus

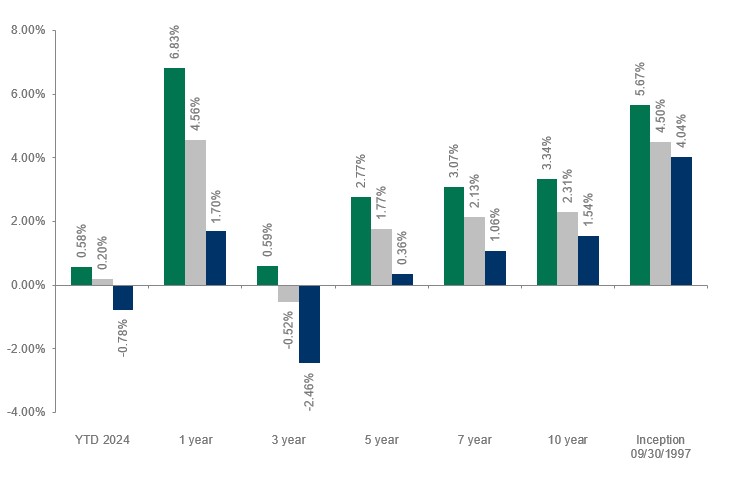

Annualized Composite Return Data through March 31, 2024

- Dolan McEniry Core Plus (Net)

- Bloomberg U.S. Intermediate Credit Index

- Bloomberg U.S. Aggregate Index